Dow: -46.23…

Nasdaq: -24.44… S&P: -4.86.

We had another sluggish day on Wall St. with the exception of the energy sector. After weeks of inventory builds, crude oil showed a drawdown of over 14 million barrels. Go figure. I think it was the largest drawdown ever. I’m sue the devil will be on the details on this one, and I haven’t had a chance to dig in yet, but its seems counter intuitive when you consider the lack of global demand. I mean the number was silly bullish for oil.

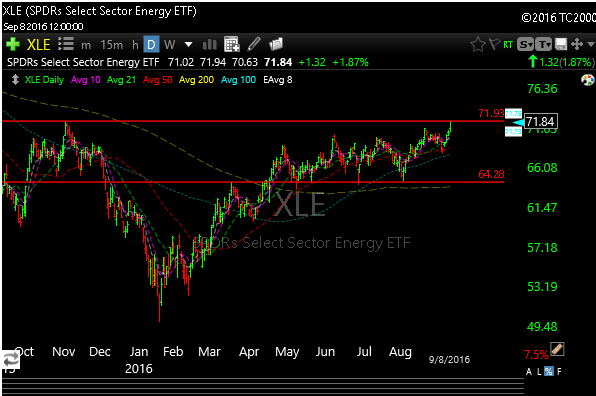

Crude was up 4.7% today which helped the XLE, but tech was weak. AAPL looks like a short to me and I may shit it soon. With the exception of the energy sector today, the sellers were in charge of things.

The stock market has been calm this summer—the S&P 500 hasn’t had a daily move of more than 1% in two months. With earnings season wrapping up, investors are focusing on economic data and comments from central bankers.

I think the bloom came off the rose a today because Mario Draghi didn’t take action on QE. He did say that he’s ready with a bazooka should the European economy need it though. No surprise.

In a market that has been doing next to nothing lately, it s nice to see some poppers on the P&L. Yesterday we saw a quick 15% pop in ERII and this morning we caught EMES right and sold 1/3 for a quick +8%. I also added new name BREW to the P&L today.

Its a stock pickers market right now and I like it. You get rewarded for isolating solid setups which to me makes for healthy market.