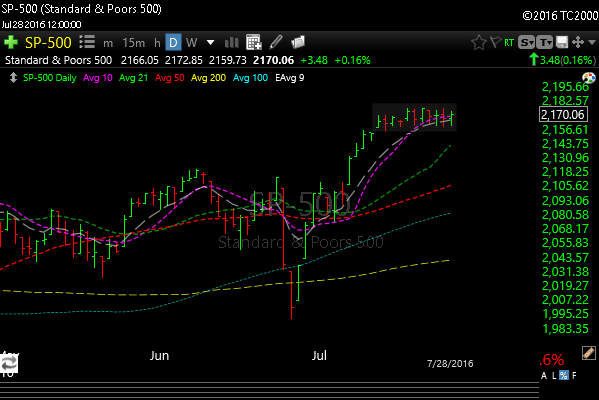

Dow -15.82 at 18456.35, Nasdaq +15.17 at 5154.98, S&P+3.48 at 2170.06

A deluge of earnings reports swung individual stocks today but left major indexes little changed. With more than half of S&P 500 companies having reported their second quarter results, the index has moved an average of 14 points between its daily low and daily high this month through Wednesday—its narrowest trading range since November 2014.

The market seems tired. The absence of big market moves even in the thick of earnings season could be a sign that the market is approaching its peak.

Word on the street at the end of Q2 was that “cash positions” among portfolio managers were at some of the highest levels of the last two decades. That’s a lot of cash to be put to work with the markets still consolidating along multi-year highs. Dips and corrections are likely to continue be bought.

GOOGL and AMZN both reported earnings after the market close. GOOG is up big, AMZN not as much.

Overall, the underlying tone remains bullish. Often when the Nasdaq and Small-Mid Caps lead, it suggests that traders are in “risk-on” mode and putting money to work into “growth” names. When the S&P and Dow lead, it tends to be more of a “risk-off” environment as their components consist of the mega-cap, dividend-yielding, “value” and “safety” plays.

The SPX has been alleviating its early July “overbought” conditions by consolidating in a narrow range. The McClellan Oscillator and other indicators I follow are not close to overbought yet.

Tomorrow’s economic data will include the advance estimate for Q2 GDP, at 8:30. The Chicago PMI for July, and the final reading of the University of Michigan Consumer Sentiment Survey for Jul at 9:45.

For those of you that are on the chatroom on a daily basis you know that I switched platforms. There are still some kinks we are trying to work out, so thanks in advance for your patience.

See you tomorrow.