For all the Pollyanna’s out there that think for a minute that this commodity rally is based on the fact that the worm has turned for the better on a global basis, well you’re very wrong. The gold miners ($GDX) have doubled since March and metals & mining ($XME) has also doubled over the same time frame.

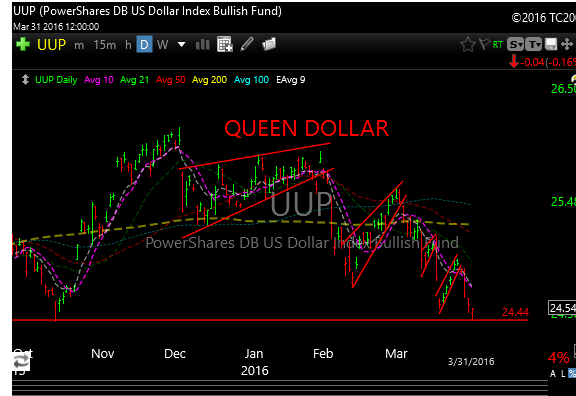

But since Feb and March, the dollar as imploded, so there’s your reason. No bunnies, no rainbows, no unicorns.

As a matter of fact, the worm seems to be turning to the downside again on the global front. Venezuela is out of water, power and electricity. The gangs are ruling the roost in the streets and crime is off the chain. I’m sure its fine.

Brazil needs an impeachment, but even if successful, it’s dying on the vine and will take a miracle to fix the problems.

Europe seems to be cracking again, at least on the charts, but they are so screwed an act of God wont save them.

Japan is on the eve of destruction, as they are NIRP themselves into insolvency. It doesn’t work, so now they are trapped. So are we thanks to Yellen. In a corner.

The $SPX lost the 2050 level Friday, maybe just an overthrow and then we bounce, but if it doesn’t, expect the worst. The 2040 level is being guarded by the Knights Watch and if that goes, well….. seeya.

Oh, and Yellen seems quite fine with going negative rates here in the good old U.S.A. In my opinion this would tantamount to an admission of guilt by the fed. Financial engineering has jumped the shark. More like financial malpractice.

Risk on is cracking, see biotech and semiconductors. The rally in energy stocks has priced in $60 oil. Good for them if it gets there, but if it doesn’t, expect a nice selloff. The banks are cute, but stay away. Too bad they cant prop trade debit cards.

Become a today.