- Dow Jones +3.6% YTD

- S&P 500 +2.8% YTD

- Russell 2000 +0.4% YTD

- Nasdaq -1.2% YTD

The S&P ended its day higher by 0.3% after the index tested, but could not make a sustained move above the 2100 level. Today’s market featured weaker than expected housing data, an uptick in oil, mixed quarterly earnings reports, and, as a result, split performances.

Crude closed up 3.3% to 41.08.

INTC guided lower after the close and is down along with the semiconductor space.

Although it was a fairly flat day when it all ended, there were some key technical breakouts in some sectors.

XLE (energy), OIH (oil service), XLF (financials), XME (metals & mining) and XLB (materials)all traded above some key resistance levels today.

The Nasdaq did poorly and tech was down for the most part. It appears for now, that tech could be getting looked at as a source of funds to buy the above mentioned sectors.

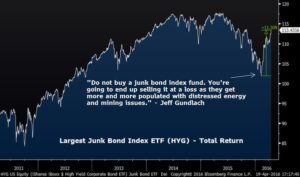

Remember when high yield was going to zero? I was one of them, but made money in the short and covered. Wonder if Gundlach is still short.

Anyway, what a rally off the lows.

The key here is to stay with whats working and identify sector rotations if there are more to come.

See you in the morning.

PS ******************************

I am starting my first ever FREE TRIAL from deep in the bowels of the Upsidetrader OpCenter and I am asking for your assistance.

If you enjoy the site, more fun things coming too, I would appreciate it if you would send this FREE TRIAL link to any friends and/or family that you think would enjoy and benefit from the site too.

Thanks guys,

Joe