It was an up week for Mr. Market. The SPX bounced right at its 200 day moving average. The Nasdaq bounced right at its 50 day moving averages. The Russell over through its 200 day ma on Tuesday by a bit, but then turned around and ripped. The antiquated Dow is still below its 200 day by a hair.

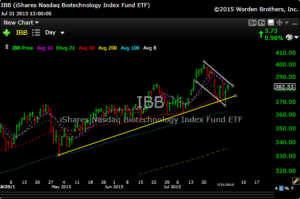

The biotech bubble busters were out in force last week, but (IBB) pulled back to a double bottom just below its 50 day, IBB then went ahead and had a great week. The big bruisers GILD and AMGN helped matters last week. As you can see below, IBB held its uptrend line (yellow) and seems to be forming a flaggy/wedgy bull pattern now.

This is an important area here. Bears are getting more vocal and the market breadth honestly does suck, so its hard to put lipstick on that pig. Guys like market timer McClellan are looking for ‘THE’ top over the first two weeks of August. McClellan has been very right and wrong at times. Just like us. Its just one arrow in my quiver as I try to figure these things out.

I’m still attracted to biotech. From my perch they still offer the most outstanding setups. Dip buys have worked like clockwork.

Here a few to watch next week.

KITE is at an important downtrend and if its gets through the 75 zone I’m looking for high 80’s

FOLD was a big mover for my subscribers in June and it looks like its setting up again for much higher prices.

CARA put a damper on my weekend because I wanted to enter first think Friday morning but I caught paralysis through analysis and missed it. Don’t do that. It was sporting a perfect bull flag and as you can see it popped above it on Friday. Two ways to play this one now. 1- Wait for a pullback to the 20 area or 2- buy a further breakout through the 21.70 area.

This has been a challenging market to say the least, but we have outperformed by a very wide margin.

Why not take my 50% OFF SUMMER OFFER and become a member today. Request this month’s performance by emailing me here.

Upsidetrader.com is a global online financial newsletter that delivers long and short trading ideas to investors in all sectors of the market. Our focus is on identifying and analyzing companies and equities that are grossly over- or under-valued. We offer regular market coverage, actionable research, and a free newsletter to investors who subscribe on Upsidetrader.com

Subscribers are directed to use the portfolio of picks and the 5-times-weekly subscriber commentary as guidelines in investment decision-making. More than 3000 stocks are scanned through daily to match each of the technical indicators for potentially explosive growth.