Well, today was fun. U.S. stocks tumbled today, wiping out gains for the year, as a worsening in Greece’s debt crisis jolted global markets and pushed the country closer to an exit from the eurozone.

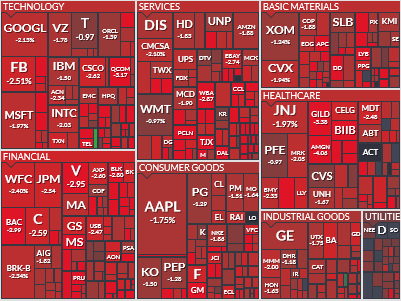

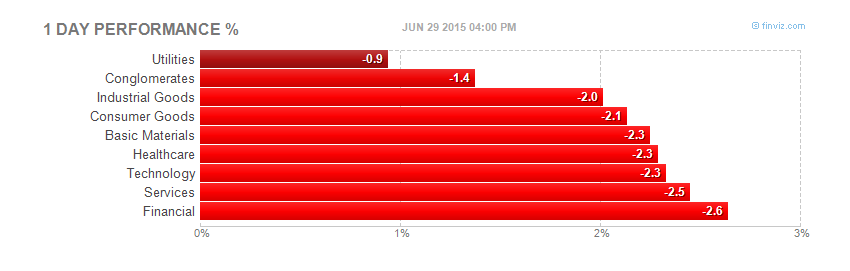

Here is a breakdown of the market by sector today.

As you can see, they threw the baby out with the bath water. No prisoners. Not unexpected when you think about it. Want to unravel markets? How about closing banks for a week over in Greece and hold the world hostage until your next meeting which is a week away. The market can handle just about everything but uncertainty.

I think you guys have seen this before, I know I have, many times. Since this secular bull market started back in 2008, these dips have always been an opportunity to start getting long. Not today, maybe not tomorrow, but soon.

You buy red and you sell the green.

Anyway, I was watching the 2070 level on SPX as support today. It failed , so the 2040 level is in play now. 2040 comes in just below the 200 day moving average at 2053.

Big swings in the Dow and S&P this week are highly likely. Stay ready and try to avoid catching knives. Knives always win. My career as a hand model was cut short by this.

Last Wednesday the market started to sell off and today was the first day that we really imploded. Was today a capitulation day? I kind of doubt it but you never know.

No one wants to be long in front of the referendum this weekend. This is a great week to look at some charts and stay prepared. Remember that cash is good in times like these. Stay patient and let it come to us.

See you in the morning.