The market ended Tuesday on a sharply lower note following a daylong retreat that was paced by the Nasdaq Composite (-1.6%). For its part, the S&P 500 lost 1.2% with all ten sectors ending in the red.

The Tuesday selloff in U.S. equities followed an overnight session that featured a 4.1% drop in China’s Shanghai Composite after some equity brokers increased their margin requirements, which led to forced selling. Furthermore, markets across Europe also struggled with Germany’s DAX diving 2.5% amid spiking yields.

Rising interest rates were not unique to Europe as the U.S. 10-yr note registered its sixth consecutive decline, sending its yield higher to 2.17%. The yield hit its highest level since early March and spent the day near its 200-day moving average, representing the first appearance near that level in more than a year.

Below is the 10 year yield (TNX). We”ve been faked out so many times before when yields rally, so it will be interesting to see if higher yields finally stick.

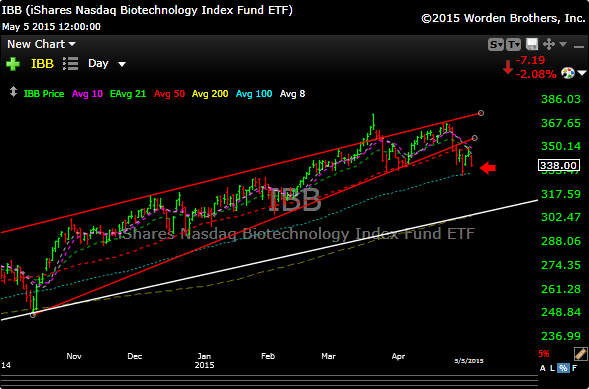

Biotech is really weak and its starting to weigh on the Nasdaq in a big way. The IBB looks like it wants a second test of its 100 day simple moving average. The QQQ closed the day just slightly under its 50 day moving average.

I don’t see anything I really like here, but that will probably change soon. In the meantime, let the market come to you, don’t “go to it”.

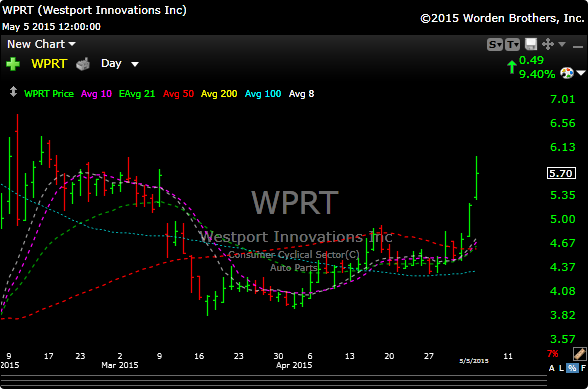

We saw a nice pop of about 10% in WPRT today, following yesterdays solid move, hopefully the good action will continue. May need a little rest since the recommendation. I stopped on URI and RENT.

Hopefully we can get this train rolling again real soon.