Yep, its the end of the market again. We sold off Friday and the SPX sits about 1.5% off the highs. My God, sell everything and move to those high yielding bank CD’s and palm oil futures. Its the end of the world as we know it. You could always move your 401K to fine art or wine futures.

On a day and when we sold off hard and pretty much stayed down, fingers were pointed at the reasons for the breakdown. The Bloomberg terminals broke down which caused mass confusion and China is allowing you to short stocks and they also raised margin requirements. There is always a reason. You decide. I just think the tape got tired again as it approached all time highs again in lackluster fashion. I guess we will know next week.

Interestingly, the biotech space (IBB) was only down only 1.4% on Friday. This is the most risk on group out there.

The last time we saw a a pullback in the SPX was around March 23. It snapped a short term uptrend off the lows then, which is similar to the uptrend pattern that’s developed over the last three weeks. It is possible that the 2040 level comes into play again, but maybe the 100 day simple moving average will act as support. That is the 2064 level.

Anyhoo, here are some setups to watch this week.

TSRO

MIFI

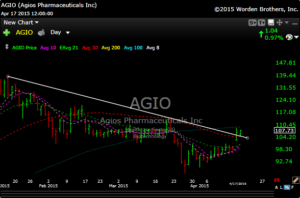

AGIO

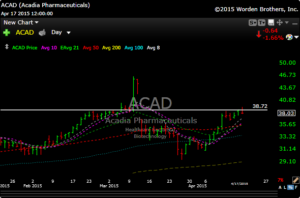

ACAD

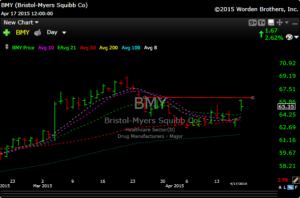

BMY

Short Ideas

MTW, RL, WDAY, BOBE, ESL, HURC

Come on by and become a Premium Member today.

Free newsletter here.