The market took a hammer to the head today as the U.S Dollar ran wild to the upside. It also looks much higher too, so as a result, multinationals got hurt and got sold. The place was a mess today.

I guess biotech isn’t worried too much about the dollar as it acted phenomenally well on a relative basis. The tape will tell us when biotech is ready to really correct, but it ain’t yet.

We had 2 triggers today: ERY and ESPR

Right now the market is throwing a kerfuffle over the likelihood of an uptick in the Fed funds rate sometime around June. So maybe the fed goes a 1/4-1/2. So what? Its meaningless to the big picture, but the market always looks for a reason to sell off when it gets a little overbought.

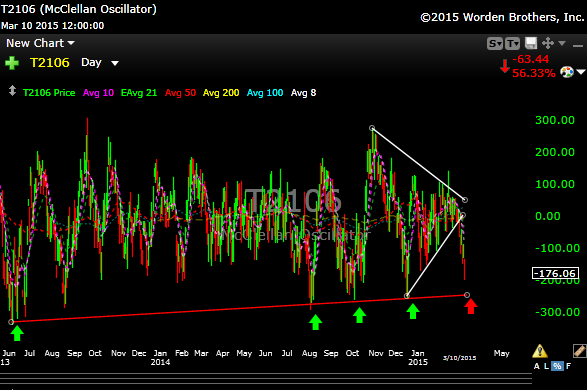

Speaking of overbought, we are now getting closer to short term oversold. Take a look at McClellan below, my fave overbought/oversold indicator. Right now its coming back down to very important support. I guess its bound to break lower at some point, but I’m not so sure it will happen this time, but that is still anyone’s guess.

It’s been “money” in the past. We shall see. As a result I will probably look to scale out of some remaining shorts tomorrow, because oversold bounces can be vicious and we are getting close.

Please remember to check the P&L tab every night so you can follow any changes or stop adjustments.

See you in the morning.