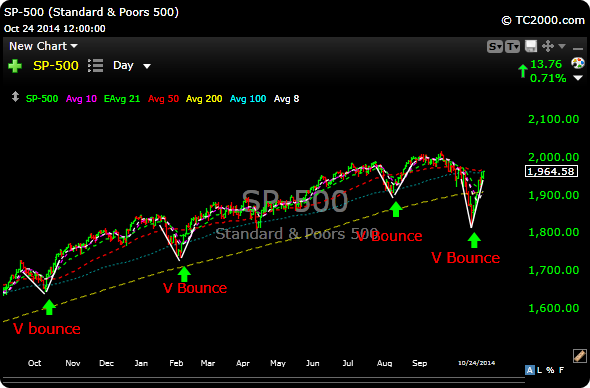

The market doesn’t base anymore. It gets overbought, pukes for a few days, then gets right back to business. We hit “crisis” lows, shake everyone out, then resume to the upside. It can be very frustrating because stops get hit, you wait for a level (dust to settle?) to reenter, and before you know it, the market has recovered 5-6%. Then the chase begins because you don’t want to be left behind.

I’m watching crude next week, a break of 80 could be an issue for the market and we are very short term overbought. $XLE and $OIH still look drekish.

The old story that bull markets don’t let you in is true. The takeaway is to buy dips, even if it feels like your driving a gas truck into a fire at that moment in time.

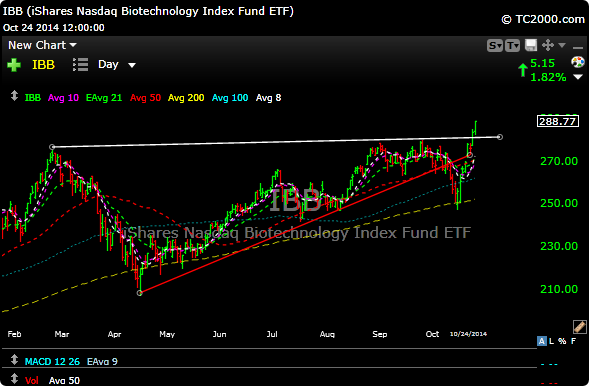

Ten days ago we hit extreme oversold levels, yet ten days later the most risk on sector, biotech, has gone on to make historic highs. Amazing. I’m long $BIIB, $MDVN, Biotech’s still have the best charts I think.

Some setups that look good include:

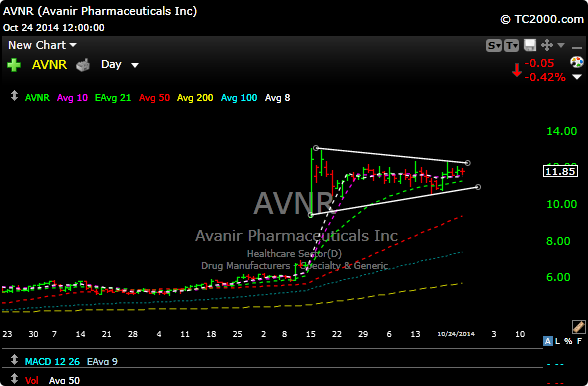

$AVNR

$ACHN

$NBIX

$BLUE – Through 42 with volume could really get going.

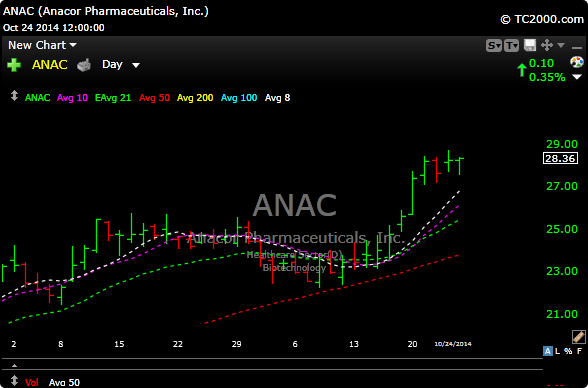

$ANAC – Watch for breakout

$AAPL – broke out last week on great volume and looks like 110-115 now

Click here for my free swing trading tips and grab a Premium subscription here.