For the day the SPX/DOW were -1.50%, and the NDX/NAZ were -1.55%. Bonds gained 25 ticks, Crude lost 70 cents, Gold rose $11, and the USD was lower.

Short term support now drops to 1869 level and 1846, with resistance a 1901 and 1929.

The SPX was down all day, but it really collapsed at around 3:40 pm when it broke the 11 am lows. It then flushed lower, roughly 17 points in only about 20 minutes to close almost near the low of the day. Really ugly. Note that SPX closed below the 200 day moving average for the first time since November 2012.

Here is the 10 minute chart.

What’s interesting and also very annoying, is that the McClellan Oscillator still wont get down and retest the lows that we saw on Oct 2. This has been helpful in the past to identify at least a short term bottom. I know it feels incredibly oversold, but the technicals suggest we have lower to go.

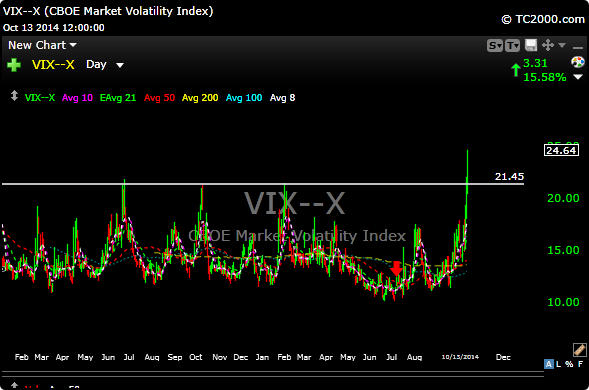

The VIX has finally caught up to the selling and exploded with a monster breakout today. VIX as you know is the fear indicator.

So what should we do now????????????????

This is an old fashioned market flush out, I don’t mean to sound like Captain Obvious, but it just is. Momentum stocks are getting annihilated and solid core blue chip names are not being spared.

The difference I see with this pullback compared to others is that uptrend lines have been violated and important moving averages have been broken. This hasn’t happened before. Does this mean we are going to crash? Not at all. But, we have all been conditioned to buy the dip and it has always worked. The technicals are much worse this time, so let it play out.

Right now we’re at the stage where there is everything to buy yet nothing to buy. Stocks you loved at 70 are now 50, but does it go to 40 first? I could show you 100 stocks tonight, uptrends are broken on 90 of them.

I haven’t been short because shorting hasn’t really worked in five years, maybe for a few days but that’s not worth it. This sell off would have been short-able because it has shown some duration, meaning more than just a quick hiccup to the downside. I feel bad that we weren’t more short, but if this market has deeper issues, then there will be plenty of opportunities.

Right now I’ve been taking my stops and raising cash, I am NOT buying anything here. This selling is heavy and its a fools errand to get in front of it right now.

We may be very close to a bottom, but that’s still an unknown. The Dow, S&P and Russell 2000 have all broken their 200 day moving averages. The Nasdaq (QQQ) hasn’t yet, but its very close. That could happen tomorrow.

Here is a look at the action in the major etf’s today.

On the positive side, the U.S. appears on a path of sustainable growth, and Federal Reserve Vice Chairman Stanley Fischer said over the weekend that interest rate hikes could be delayed because of decelerating growth elsewhere. Europe is a big overhang right now, so that still weighs. A fix in Europe would be a huge catalyst for the bulls, granted easier said than done.

This will pass and we’ll get a game plan soon. Let’s wait for things to settle.

See you in the morning.