The trend is still just fine, but the market took some hits today as the Alibaba hangover kicked in a bit. Here is a look at how the etf”s fared. Not so hot.

The SPX closed right on its 20 day moving average. Next support should that break would be around 1975, which is the 50 day moving average.

The problem child again is the Russell 2000. As I mentioned in last night video, yje Russell was in a bear flag last week and Friday it put in an ugly bearish engulfing candle. That isn’t bullish, and today it followed through to the downside and closed down another 1.4%.

In case you haven’t noticed, China is correcting. FXI is down almost 10% since it tagged highs back in early September. So right now risk is off in our small caps and China too.

As I mentioned last night’s video, it’s probably a good idea to tighten stops and reduce size here.

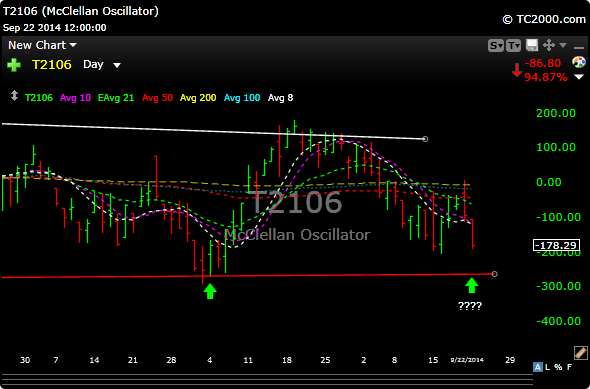

The McClellan Oscillator shows an oversold reading, but could still get a little more extreme before it reverses.

I will leave last night’s new additions on for now in case we get a rebound higher.