{+++}

I’m not necessarily bearish on the market, let’s say I’m more adamantly neutral. It’s tough to get bullish when only two of the four major indexes are working the way they are supposed to.

Seasonality factors are against the market right here, that is if you believe in that kind of stuff. And let’s not forget the dreaded “sell in May and go away” folks are out and about. The chant will get louder too on the first big down day. Bottom line, because of this, it wont take muck to get the bears motivated and pressing their bets. Especially without much in the way of any near term catalysts.

It’s obvious that momentum and risk on names continue to get sold because the NYSE and S&P stocks are working higher and the Nazzy and Russell are moving lower.

No one cares about growth stocks and their related stories right now. They just want value and low PE here. This may or may not last. We have to watch

I posted some thoughts on the Russell and Nasdaq here over the weekend.

Here are some ideas for the week ahead. Note that I have now started the May P&L and we had only three names before tonight’s new additions. 3 shorts and 1 long

GTLS (short) —- In last Sunday’s post I mentioned this a short idea. The stock dropped $10 bucks out of the gate Monday and Tuesday of last week. It has made a feeble bounce up to declining 8 day moving average resistance. I would get short on a break of Friday’s low around the 69.70 level or short a a little higher should it bounce. The stock is in a bear flag and looks lower. Bear pennant is forming.

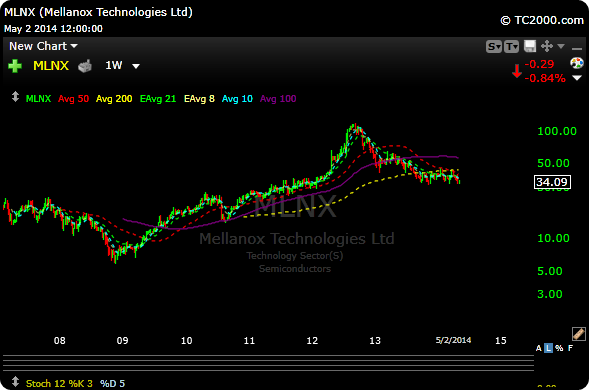

MLNX (short) —-Was the darling of 2012, but not anymore. It’s a cycle stock and if the cycle int going its way (and its not) they sell it hard. Thsi is also in an ugly bear flag. A break of 33 will send this one lower. That is the short price.

As you can see on the weekly chart for MLNX there is a long way down should things get ugly.

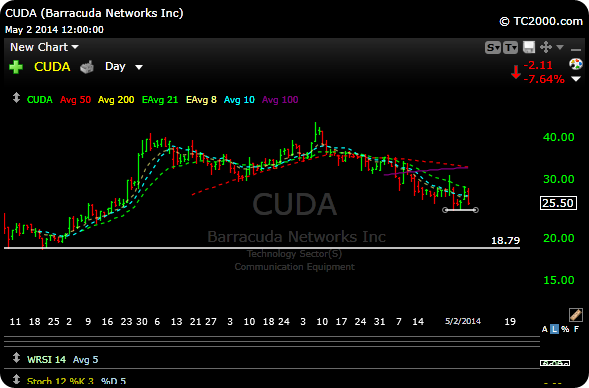

CUDA (short)—-This one has been going down with the rest of its group. If it breaks support around 24.30 we could see the 21 level and longer term maybe lower.

MXWL (long) Had a good earnings report and has a nice daily and weekly chart in place. Buy the 17.07 level.

Some other ides that could be shorts include: CERN, WDAY, PANW, YNDX so keep your eye on these too.

Good luck this week and I will see you in the trading room in the morning.