{+++} I spent yesterday trying to catch up on some of the action I missed on Friday. I see some of the momentum names in the technology space got sold off a bit. FEYE got sold off on the announcement of a secondary offering, but I did see that there was big call buying in the name on Friday, so my guess is after the dust settles that one can resume its march higher.

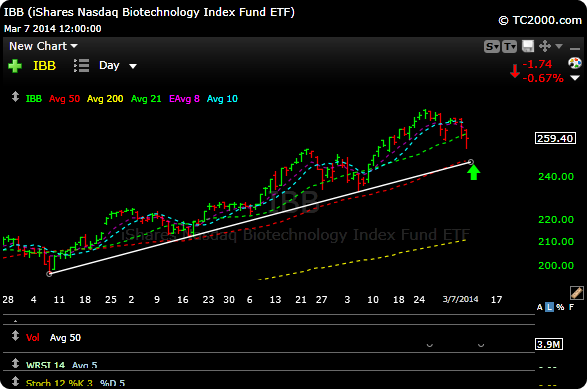

The biotechs got thrown around bit too after the FDA came out cautious on names like REGN as they had some questions. At one point REGN was down around 40 points from its high for the day, REGN is also the second large holding in the IBB so it is a benchmark. The stock held its 50 day moving average and bounced hard which was a good sign.

The IBB closed below its 20 moving average and the volume on the sell side has been pretty powerful over the last week. Its still my favorite group, but as you can see in the chart below, the possibility exists for a test of the uptrend line which is also right around the 5o day moving average. Its getting quite oversold but still may need to go down and test those levels. Maybe not, but just be aware.

I mentioned in last Sunday’s video that the I was starting to look at the financials bullishly again although I never had a chance to get it on our list. I mentioned BAC and MS as attractive candidates, they had a good week along with some others and the sector may be taking back a leadership position. I will be a buyer of the group if I’m luck enough to get a pullback. That potential head and shoulder pattern on XLF was unvalidated as the sector broke out last week.

The market is at that point again where it probably needs a rest. Right now (not to oversimplify), we will go sideways and correct through time and not price, or we will pull back 3-5%. We can also just correct through sector rotations, meaning for example, healthcare could see profit taking, but that money will move to the financials. We’ll see.

Here are some new swing trades I am adding to the P&L this weekend.

TSL is one of my favorite solar stocks based on the chart. On Thursday the stock had a big volume breakout and a bullish consolidation day on Friday. Buy the 18.80 level.

NBL is working a bullish flag on the daily. Buy the 70.50 level.

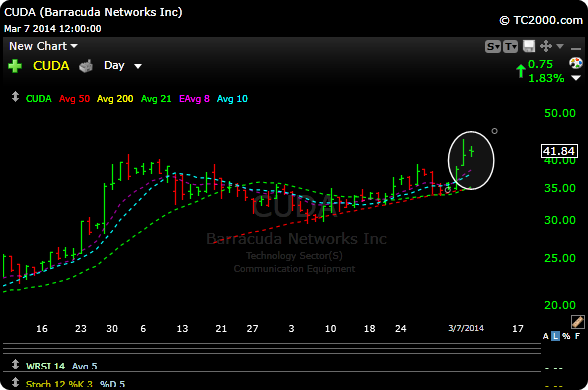

CUDA had a breakout on Thursday and posted a bullish inside day on Friday. Get long over Thursday’s high which is the 44.40 price.

OGXI is coiling and buyside volume has been good indicating accumulation. The MACD also crossed up positive on Friday. Buy the 12.93 l3v3l.

Have a great Sunday and I will see you in the trading room.