Chuck Jaffe at Marketwatch opines:

“The crash in 2007-2008 falls off the books soon. Mutual fund are watching as the passage of time removes all of that pain from five-year performance records. While the financial crisis actually sucked 50% of the value out of the $DJIA over an 18-month period from October 2007 through early March 2009, funds took the worst of it in the two months after the Sept. 15th collapse of Lehman.

Removing that experience from the five-year look-back creates a before-after picture that’s as startling as the sudden transformation of a 98-pound weakling into a pumped-up, sculpted contender for Mr. Universe.”

For example, the average large-cap growth fund entered September with a five-year annualized return of 6.38%, according to Morningstar Inc. If the market simply stays flat and the average fund stands still to the end of the year, that five-year average will be 9.2% once September is wiped off the books, and will reach 15.16% by the end of the year.

When you take the fall of 2008 off the books, according to Lipper Inc., the cumulative return of the average large-cap core fund would go from 37.82% entering September to 94.14% by the end of the year. The typical financial-services sector fund, which now reports a total gain of 27.5% since August 2008, will see its five-year results shoot to roughly 106.5% by year’s end, simply by holding steady for through December.”

Interesting stuff.

……….

Anyway, the market had an interesting week. Bullets were flying everywhere. Basically if you were long, you got crushed, then the market gave you your money back. If you were really short going into Thursday, then maybe you’re in therapy this morning or speed dialing the suicide hotline. If you got really long Wednesday, then you bought the bar last night. Bottom line, the $SPX ended up about 15 handles higher than where it started the week. The S&P also corrected about 85 handles from the 1729 high to the intraday low on Wednesday. Good clean fun.

So far earnings season has kind of sucked, as I am seeing more failures to launch than big successes. But there are always some mini disasters and great surprise wins.

Here are a few names that I think will do real will as we get close to Christmas.

$EVR Nice company and a nice set up. Very underrated financial. I can see 55-60 by year end.

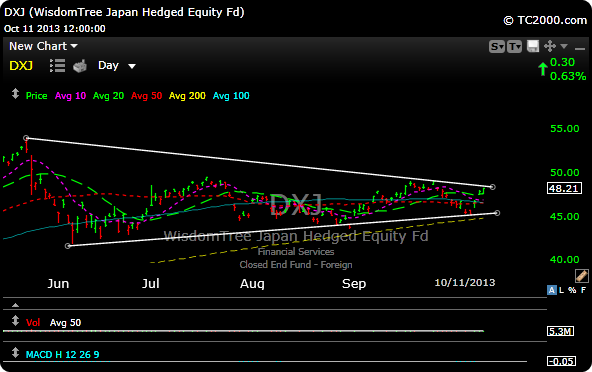

$DXJ – I like Japan going into year end and think the Yen is ready to pullback. I think the May highs eventually get taken out.

$CLDX Yeah I know biotech got crushed last week. It’s the biggest risk on group out there. In a better market this will thrive. I like the pullback here and I like that it tested and held the 50 day moving average twice. I still see 40+ on this one.

$NBG Yeah Europe is still a mess, especially Greece. Thats why I like this one. $7-8 is possible into year end.

Have a great weekend. Come by a free trial here.

What you get as a Premium Member:

Real Time trading room that I personally moderate. I give sets ups and posts live charts with analysis daily in the room, so you will learn pattern recognition which is key.

Profit and Loss table that is updated every night on blog

Market recap video every night where I will highlight big movers and new ideas

In depth market video every Sunday.

New swing trading ideas during the week with entries and stops. Entries, when to sell, and stops are part of the program