Biotech stocks are on an HGH, epinephrine and crystal meth cocktail right now. The $IBB (iShares Bio ETF has gone from about 85 to a close of 193 over the last 23 months.) In August of 2011, the ETF bounced off its weekly 200 day moving average and has never looked back.

I remember trading biotech stocks twenty years ago. They were crazy then too, but paled in comparison to the action we’ve seen in this sector lately. They weren’t ready back then. They were years away. Now they’re popping on a daily basis, as many enter those later stage FDA trials. There are also many more of these stocks now too, so the likelihood that one is filing a new drug app or waiting for a Phase 1,2 or 3 approval is more prevalent. There is also the potential for major joint venture announcements or outright takeovers by big pharma. (See the 120 cash bid for $ONXX by $AMGN a couple of weeks ago). There also seems to be conferences every other week that are hosted by the big banks, which feeds the rumor mill weeks before the event. So news flow is everywhere, almost every day and week now.

So bottom line, there is “always action” in some form or another. I love action when I trade, and this group is primarily what I’ve been trading. If you want alpha then you need biotech.

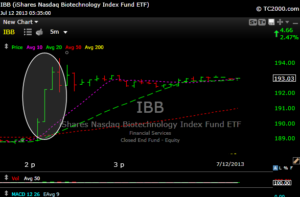

Yesterday, the biotechs were meandering along until about 2.05 PM when out of nowhere a story was reported by Bloomberg, that Roche was interested in buying $ALXN. You can see what the stock did on the 5 minuter chart when the news hit the tape. (5 minute chart)

This is what $IBB did on the same time frame.

I always say it’s better to own a weak stock in a strong group than a strong stock in a weak group as the the “rising tide lifts all boats theory kicks in. You can see what the sector did in the chart immediately above. Boom!! The group exploded.

Here are some names that I either trade or own. They all look higher.

$AEGR This has been a huge winner this year. It broke out hard in mid May, then flagged and went higher yet again. It consolidated and built a base for a month or so but tagged more all time highs on Friday.

$IMMU– We took this one long on Friday. Look for a breakout next week.

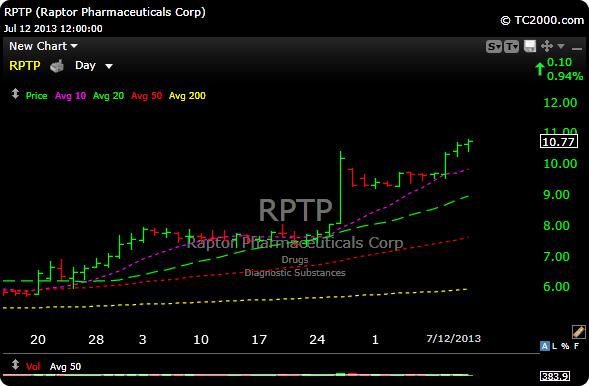

$RPTP We took this when it broke out of the flag last week at arounf 9.75. May need a little rest, but I see 13-14

$ASTX was a big winner for us earlier in the year. It pulled back, tested its 200 day ma support and is now moving up. On July 2 it broke out of downtrend line (bullish). I can see it back up near the 6-7 level.

$CYTK could be a big winner for the balance of the year. We are long at 11.50. I see high teens, low 20’s by year end at a minimum.

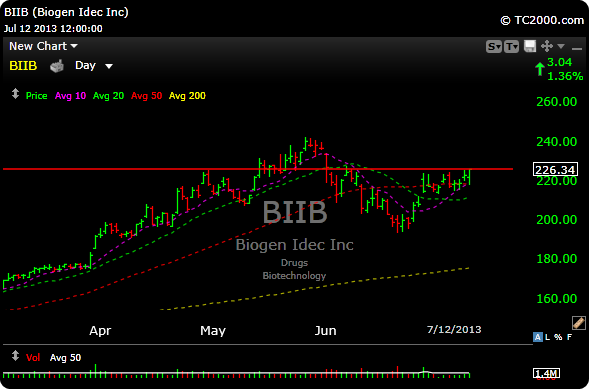

$BIIB is like the Cadillac of the biotechs. The stock is still a buy and looks like it will make more new highs this year.

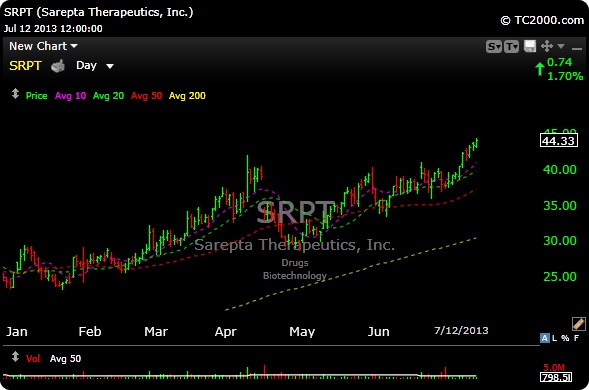

$SRPT Has been a great performer this year. The noise around this one is a possible fast track nod by the FDA on a very important drug. Risky to get in front of a FDA decision, but probably 20 points up on good news……maybe the same move lower on bad news. At this point it’s probably best to play it with options so you have defined risk.

Bottom line is that I could go on and n because IO love this group but there isn’t enough time.

If you would like to see m ore detailed analysis and more set ups, you can subscribe here. You can also request performance here. Have a great weekend and good luck trading next week.