Ben never planned to rip away the punch bowel, but his plan all along was to use a bigger ladle while no one was watching, to draw from the punch bowel, this way it would be gradual. His plan is working like a charm as yield goes higher and price goes lower. It would always be telegraphed, gently…he has a bubble to protect for now. This is how repricing works. Better now than later.

The 10 year Treasury ($TNX) is now yielding 2.17 % and the 30 yer treasury ($TYX) is yielding 3.30%. These yield upticks are fairly monstrous when you think about it. A 30 year bond auction recently received less interest from buyers in years. No one wants bonds or notes. This doesn’t mean the 10 year goes straight to 3% or the 30 year goes to 4% right away, but the dye has been cast, as The Bernanke “preps” and telegraphs the market.

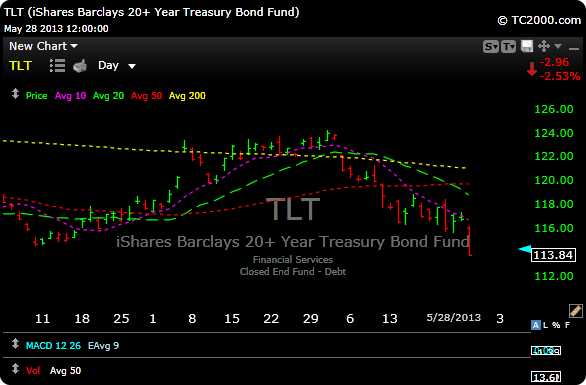

$TLT is dropping like an anvil and $TBT is starting to trade like a biotech.

The $SPX blew out of the gate yesterday, but looked at one point, that it would give back the entire move. This morning, the $DJIU is tanking about 100 points at the open, so it looks like we may be reentering that period not so long ago, where the market popped and dropped a 100 points everyday. Great for traders, good action.

Trading should be excellent as these big swings offer opportunity galore. Repricing is a good thing, nothing stays the same forever. Right now, the market is adjusting and trying to figure out how to deal with the rate moves. The market always figures it out.

Grab a free trial here.