Stocks go up in down markets and stocks go down in up markets. These days you’re a heretic and traitor to the cause if you even reference a short idea. It’s like mentioning a negative to an $AAPL fan boy. You won’t win.

Anyway, here are some names that are starting to look a little nauseous.

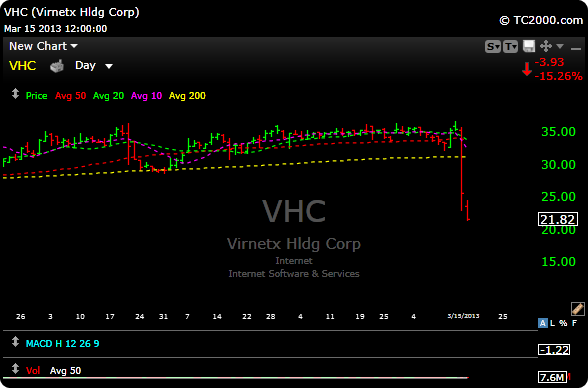

$VHC– Relying on a judge and jury to make you money is tantamount to playing an earnings report. Riverboat gambling. This stock is broken and can go lower. Target 17 area. Probably best to short bounces.

$ALB– Took out its uptrend line on Friday, “may” be the start of a move lower. Possible move to 59 which is the 200 day moving average.

$AOL– Has been a huge winner, but is showing some cracks in the armor recently. Needs to hold the 50 day MA at 33.78, if it doesn’t, look for it to fill the gap with 30 as a target.

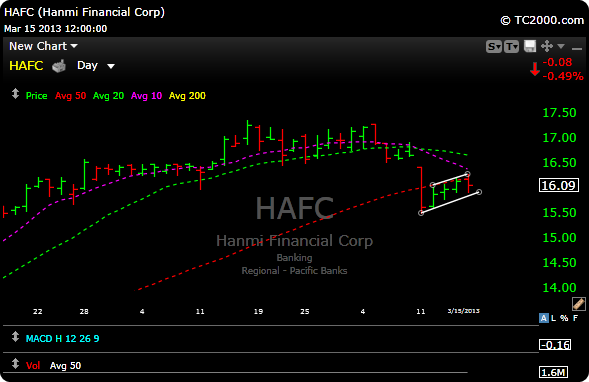

$HAFC– broke last Monday and has done nothing more than develop a bear flag. If it breaks 15.50 it could have problems.

$TSCO – is a great stock, but it broke a bit last week, as it lost its 10 and 20 day moving average support. Sell side volume was big on Friday. It’s sitting on some short term lateral support, but if it loses this level, it could be a trade to 95 (gap fill) and the 200 day moving average which is around 93.

Bottom line, shorting is a fools errand these days. Pullbacks are all shallow and buyable (if non-existent) These are just a few names to keep on your radar for when we do pullback.

Free trial here