I find it hilarious that we are making new highs almost every day in the indices, many stocks and sectors, yet all the pundits can talk about is the Fed taking their foot off the pedal. They have been wrong on every turn, so now they are reduced to the great “what if”.

David Rosenberg hasn’t been right since the Age of Pericles, yet he goes on and in and on. Mark Faber has become silly entertainment and Roubini is the new international George Clooney of the Apocalypse. Don’t get me started on the sequester jesters in Washington.

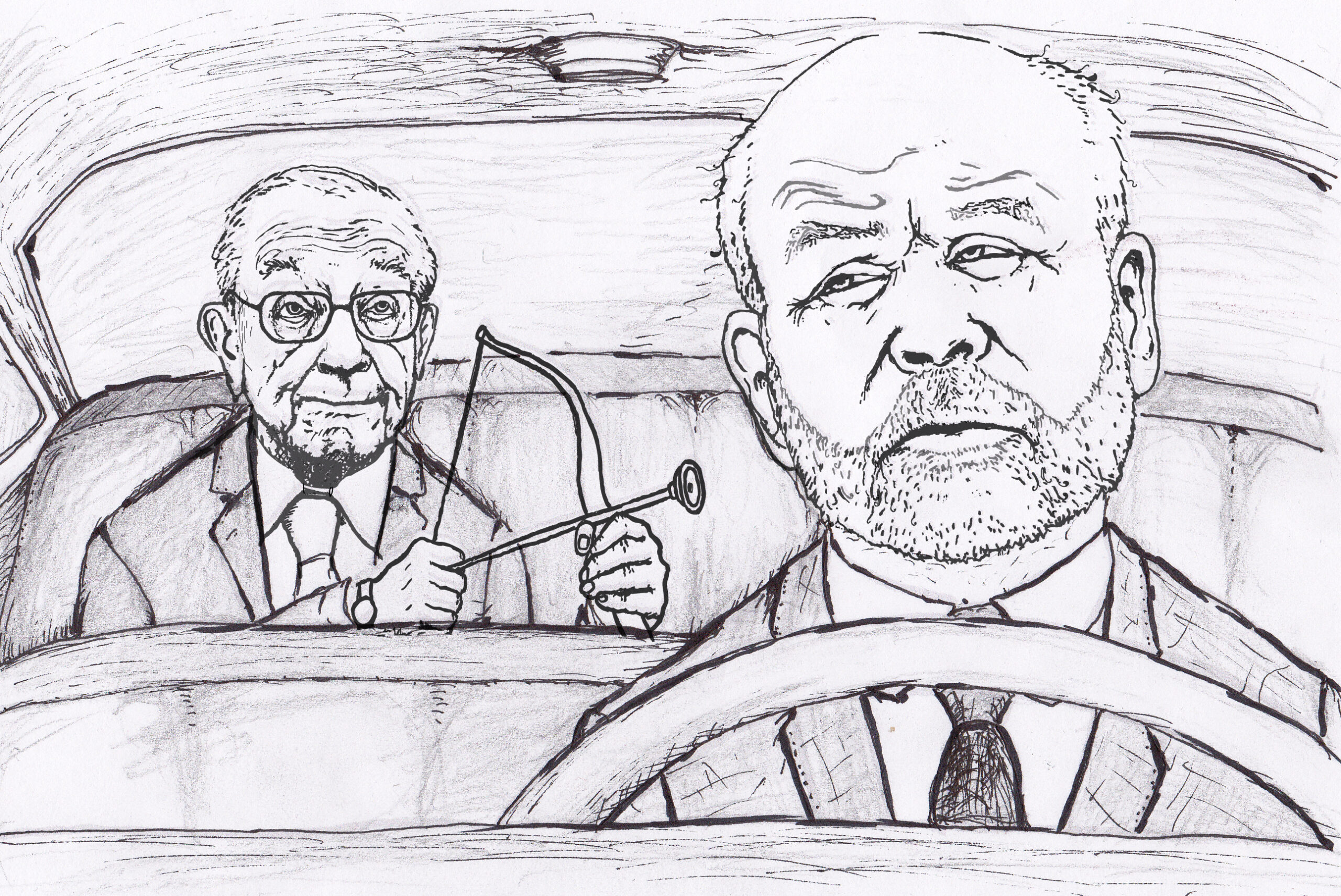

Sure the Fed will stop at some point, but don’t ever forget that in the new era of our bubble wrapped society, it wont matter. What do I mean? Father Ben knows he has to telegraph any change in policy months in advance. He must “prepare” his market for bad news. God forbid the market should be “shocked” with bad news. Gone are the days of a “flash” Fed move during trading hours. Bernanke will protect his market like a soccer coach protects the kid who sucks. Never a harsh word and the kid will get a trophy no matter what. Artificial markets have to be coddled and caressed, anything less would produce an apocalypse. And yes, this market is “his” market. He owns it, good or bad. Greenspan did.

Trust me, I don’t care why markets go up or down, I’m just sayin’. I will say that the data has been good. Don’t fight good data and don’t fight zero rates. You will lose every time. Bull markets don’t need a splash of over the top good news to go higher, its just needs to avoid really bad news. Bull markets absorb bad news well anyway.

Unless you are a retiree that needs income (they want Bernanke’s head on a stick), you love The Bernanke. How could you not?

I will have some Sunday setups out on Stocktwits tomorrow. In the meantime if you would like to request performance or take a free trial, go here.

$SPX $QQQ $IWM $DJIA