{+++} Let’s see if the market can bust it out next week. The S&P cash needs to get through 1530.94, write it down. A close, not just a breakout through that level is key, as an intra-day move through it without a close above it could be bearish for the short term, as it could signal that buyers have lost conviction and are exhausted.

In the spirit of not being a top caller (because no one knows), I’ll continue to play long sets ups and tighten stops as things move higher. Here are some setups I will be looking to buy this week.

Note: Not all stocks will trigger, so concentrate on the ones that do.

AGN– buy the 109.31 level. This one has been coiling for quite a while and may be ready to go.

VRSN– Buy the 46.70 level. Target 50 id it can breakout through that level with volume.

ACAS– has now moved above all of its moving average resistance. Huge volume is coming in which should bode well for higher prices in the future. Buy the 14.27 area.

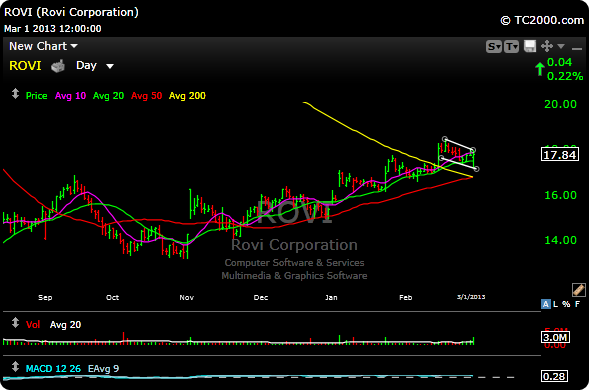

ROVI– was a $ 50 stock just over a year ago, but it has now cleared all of its moving averages with the exception of the 10 day ma. It is also working a mini wedge or flag. Volume has also been exceptional. Buy the 18.15 level.

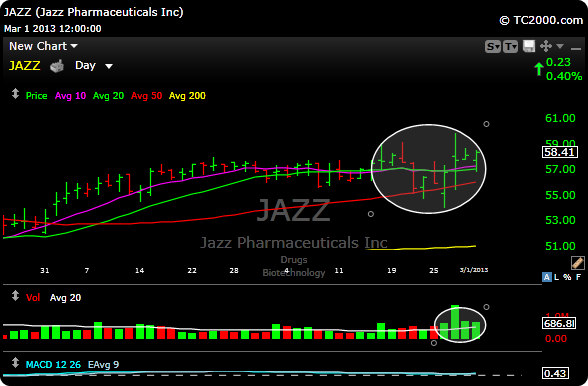

JAZZ– is seeing huge volume off its earnings report. Play the breakout at the 59.90 level.

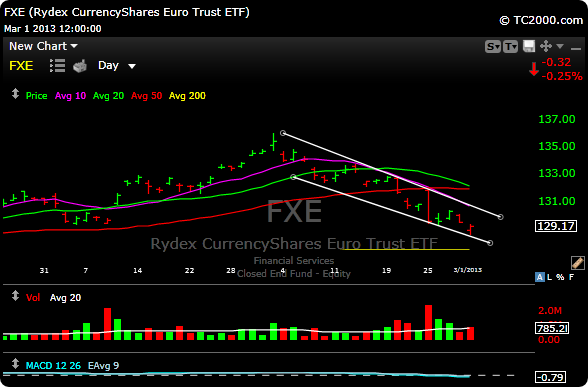

FXE– I think the euro is close to oversold, see the range level to buy on the P&L. I also did a more in depth review here.

ACOR– is also coiling and could break out market permitting. I would look to enter at the 31 level.

NXST– Some of the smaller broadcasting companies have been breaking out all over the place. (See SBGI) Buy the 15.50 level.