Italy has become a joke of a government and Spain is no choir boy by any stretch with their 26% unemployment rate. The nanny state countries are a mess, but we’re all rooting for them. Italy needs a Pope and Prime Minister. Berlusconi tried his best during the time he wasn’t chasing hookers, porn stars and drinking goblets of Chianti while nibbling seedless grapes from the vine.

Price wise, European stocks and etf’s put in a top around February 1. Italy started running into trouble and they have all cascaded down after the short squeeze and temporary sentiment change that led them up. (See charts of $EWG, $EWI, $EWP, $EWQ).

I say balderdash. Buy the euro for swing long and I will play this via $FXE.

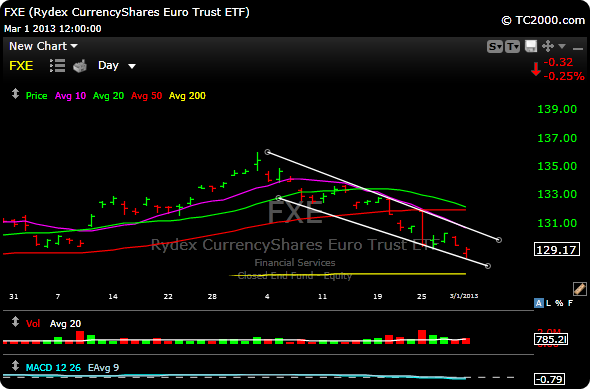

As you can see below, the euro is approaching support at the 200 day simple moving average. That level is approximately 1.29. Keep in mind that 50 day moving average on the weekly chart is around 1.28, if that gets violated close the trade. I would however look for support to kick in at the 1.29 level (200 day).

Like the euro, $FXE is in a falling wedge so any type of good news should lead to a relief rally/short squeeze.

The best entry for $FXE may be the 200 day moving average (yellow line) around 127.50. You can nibble here with your stop (mental or hard) if the euro breaks 1.28

Free trial here.