Is that all you got? We pulled back Wednesday with a follow through lower on Thursday until the dip buyers showed up. On Friday, the $SPX rallied almost a percent higher. With Friday’s rally, the $SPX only lost about fifteen handles from top to bottom last week. No biggie.

That doesn’t mean we aren’t going lower before we go higher. The market may still need to work off some overbought conditions and back and fill a bit. If you can pick stocks though, you’re making money regardless, because there are great set ups and breakouts all over the place. Dare I say it, but it is a stock pickers market. Stocks like $PCYC didn’t care about the pullback and just kept going. There were so many more.

As you can see in the daily chart of $SPX below, a few things happened last week. The 10 and 20 day moving averages were broken, as well as the uptrend line. The 20 day ma was recovered on Friday though. What will sometimes happen on this kind of a sell off is the index will rally back to the “break” (in this case, back to the uptrend line, red arrow) and then fail again. This may not happen, as we could just go on to make more highs, but it bears watching. Don’t get caught in a mini bull trap.

There are cracks in the armor though, which is normal after this move up. The housing stocks $XHB got a dose of reality last week. Many of the builders were way overbought and priced for perfection.

As someone pointed out, in the case of $TOL, it is trading near 2007 levels when it had four bucks in earnings, it is now earning way less. You can decide if you think that’s a “little much”. How much the group pulls back depends on how perfectly things go from here. Nice $XHB chart below with support at the weekly uptrend line.

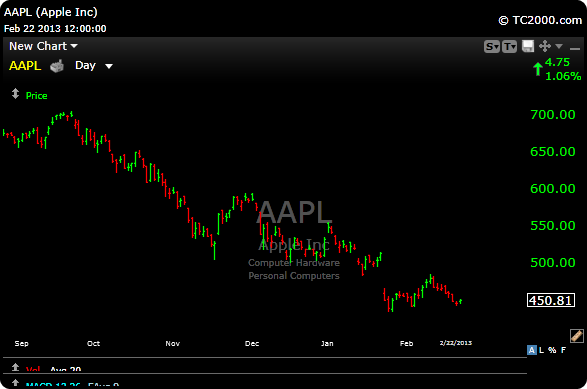

$AAPL has had the absolute snot knocked out of it. 30% of hedge funds sold their stakes last quarter and $AIG has replaced it as the new hedge fund favorite. The stock is also down about 30% since they started that “bullish buyback”. Don’t ever take that bait. Buybacks are ridiculous. The stock did put in a bit of a doji on Thursday and the MACD “may” be trying to turn up. Not calling a bottom, but it may have found a level for now. There is always the chance though that it has to go back and flush out those January lows, so caution fan boys.

I will have some setups posted here over the weekend is you want to check back in.

In the meantime, sign up for a free trial here or request performance at the Performance page at the top of the blog.