“The borrowing has to stop. The market slide was a shot right between the eyes that had better wake us all up to the simple fact that we can’t keep romping forever on borrowed money” -Lee Iaccoca, Chrysler Chairman, Oct.1987

In September 1987, the economic concerns over the weak dollar and rising interest rates started making investors nervous. Volatility in the market increased dramatically as both good and bad economic information was in the news. A record single day point gain for the Dow was set on September 22nd, only to be followed by the largest single day point loss on October 6th. During the three days of October 14th through 16th, the Dow fell over 260 points and the S&P 500 declined 10%. The volatility of the market created a great deal of anxiety over the weekend. Investors were left wondering what would happen on Monday.

Program trading was a new tool, and was introduced to take advantage of rapid market movements. On Black Monday, program trading moved millions of shares, and clients as well as investment houses were left wondering what their actual market positions were like for most of the day.

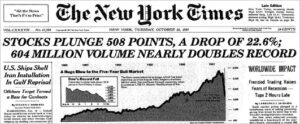

Portfolio insurance and program trading were intended to help investors take advantage of short-term market fluctuations. Unfortunately, these two systems, along with a lack of investor confidence, drove the Dow Jones down 508 points. This was a 22% decline in value in just a single day. Investors in the stock market would lose over $500 billion on Black Monday.

Always Buy Crashes

It’s the hardest thing in the world to do, but had you bought the 87 crash, or for that matter the 08 crash, you would sipping coconut drinks on a pretty little island. Look how far we’ve come from the 87 crash, just 25 years ago.