So many indicators, so little time. The “sell in May” folks were right, but the folks that said to avoid September were wrong.

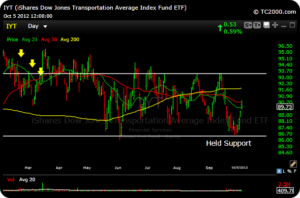

The Dow Theory folks will tell you to avoid stocks while the transports ($IYT) are in the crapper. As you can see below, the ETF for the transports has looked like an EKG, but for the most part has looked lousy. The market though, still flirts with new yearly highs. The transports held lateral support last week and bounced hard.

$SPX – The S&P (cash) has been holding the uptrend line and 20 day moving average like a champ so far. It broke the 20 dma a few times recently but never closed below it. The tape looks tired, but that can be normal behavior as it churns before new highs. It can also be a warning sign for a correction, so be cautious.

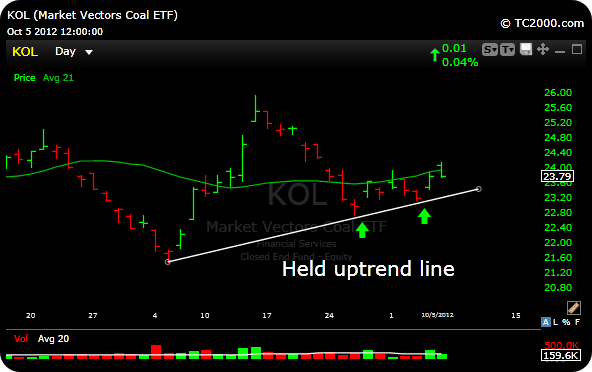

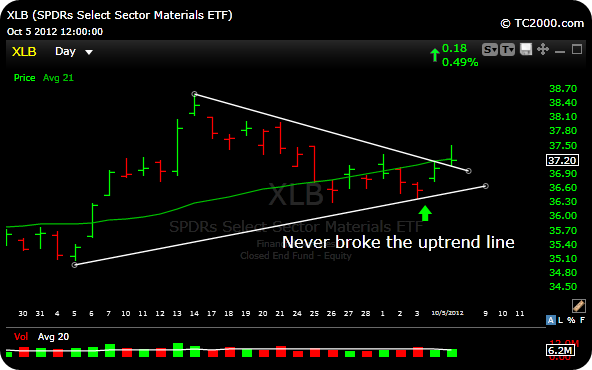

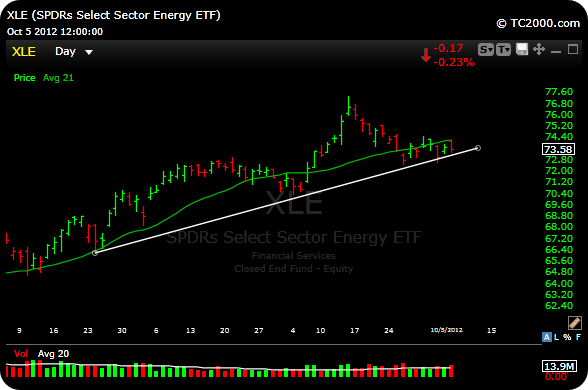

Groups like materials ($XLB), coal ($KOL), and energy ($XLE) have yet to really light it up, but should at some point soon, considering that we have “Qfinity and Beyond”.

$KOL– The coal ETF is interesting as it has held its uptrend line and may actually be putting in an inverse head and shoulders pattern. As you can see in the chart below, the right side if the right shoulder may be starting to form. As you know, I’m wicked bullish on coal (not a quick trade for me). I like buying stuff the planet hates.

$XLB– The Materials sector is hanging around. It made a move abov eits downtrend line and managed a close around the 20 day moving average. Action is soft so far.

$XLE – The energy names had a great rally off the June lows and are taking a breather. The ETF is still holding its uptrend line, but remains below the 20dma. $CVX and $XOM are the biggest weighting in this ETF.

$XLF – The banks have had a good move, and the uptrend is still in tact, although a pullback to the line wouldn’t surprise me.

$AAPL – You cant talk about the market without looking at Apple. It’s a huge chunk of the Nasdaq and a big chunk of the S&P. This stock can be a gift or a curse depending on its mood at the time. Last Tuesday, AAPL broke its 50dma support, but than managed a rip to the upside and it followed through on Wednesday. Things however git dicey on Thursday, and it caved in on Friday, this time closing below its 50 dma. It also came within about 60 cents of Tuesday’s low. That number is 650.65. Knowing AAPL it may just overthrow that price, bring on the shorts, then embarrass them and rip higher. It should be an interesting week for the stock.

My Premium Site is on fire. To become a member, or to request performance you can email me at: [email protected]

To become a member you can subscribe here.

What you get as a Premium Member:

Real Time Chat Room– (I’m on it all day), we talk stocks and this is where you will get real time day trade entries. Last week we took about 40 points out of AAPL, GOOG and MLNX alone. It’s educational and fun.

Sunday Video– Every Sunday I publish and an depth video that discusses the week that was and new set ups and analysis for the week ahead.

P&L– The subscriber P&L is updated nightly. This is where you will find entry prices and stop levels. Any exits are updated almost every night.

Some profits taken by subscribers so far this month include:

$ALNY +52%, $MDVN +16%, $AFFY +56%, $DPZ +10%, $FST +16%, $MS +18%, $GNRC +15%, $CLDX +13%, $VCLK +6%, $CSOD +12%, $AOL +7%, $FIO +5%, $BAC +4.5%, $FAS +6%, $XNPT +6.3

Good luck next week.