The tape got throttled on Friday and the baby went out with the bath water. Mr. Market was an equal opportunity seller and the market Gods are rarely partisan on that front. All the sectors visited the wood chipper, but energy ($XLE) and crude were particularly brutalized. I remember when lower crude was good for the market, I also remember when higher crude prices were good for the market. It all depends on that place in time I guess.

The jobs number wasn’t good and we were fresh off some tepid (at best) economic reports. Europe sort of ruled the week, as the markets got all twisted about the Sarkozy election this weekend. The market was looking for a reason to let some air out, and it did.

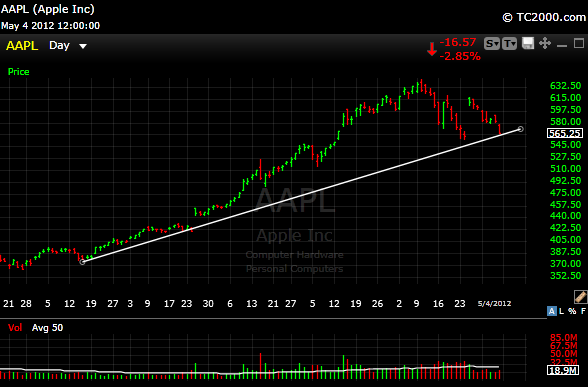

$AAPL is falling apart, but the volume last week was still below the 50 day moving average. It also managed to close at some trend line support as you can see below. It also managed to go back and fill the earnings day gap on Friday. If it doesn’t holdhere, then your next probable level is the 550 area.

I’m back to looking at my trend lines for now. When markets hit lofty levels and then turn on a dime like we saw on Friday, I find them more telling and dependable than moving averages. As I opined here a while back.

Everyone wants to know (including me) if this is the start of a disaster for the market or just another gift to buy “stuff” cheaper. I don’t have the answer, but watching your trendlines (use your daily AND weekly charts) will help. So far, every dip has been a buy, but that trade only works well until it doesn’t.

Here are some sectors that need to be watched like a hawk next week. Many times, stocks and sectors will “overshoot” their trendine support levels by a little then rip higher, so keep that in mind. Most of these sectors are at key levels, so a break of these levels with big volume could become a worry. These are also levels where they could bounce to the upside in a violent fashion. These are merely my observations and not my predictions. Good luck next week.

$XLF

$XLE

$XME

$XLK

$XLB

Subscription information here.