{+++}

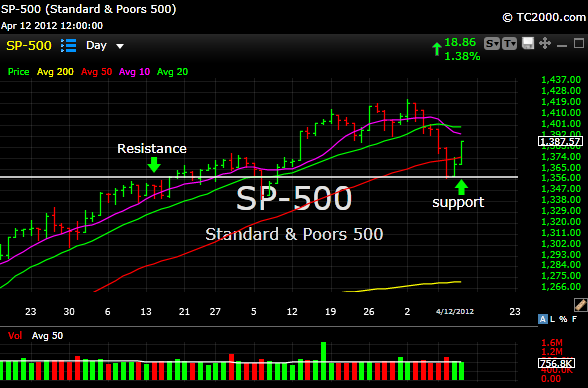

As you can see from the white horizontal line on the chart above resistance from back in mid February acted as support when we sold off. This is where the market bounced hard. Actually a hard 30 handle bounce.

Everything was in play yesterday with the exception of AAPL which seems to be taking a rest. AAPL reports in about two weeks and don’t count it out. From my recollection, it seems to do this a lot right before earnings then it catches everyone by surprise and rips higher. We’ll see if history repeats.

The market ripped yesterday, mainly commodities. There was s rumor in the morning that China would report a better number than the estimate. Everyone is watching China because they still seem to be the tail that wags the dog. As a result of this rumor, energy, metals and mining took off. Asa result XME (metals and mining ETF) was up 5%. That’s big.

Reality check: China reported this morning and the number was actually a bit under estimates. So far the S&P is down about 1/2% on the China shortfall.

JPM and WFC reported and the numbers seem OK with no real negative surprises, but both are trading a little lower. It will be important to see what they say about housing. The dollar is up so it could be a rough slog at the open.

Housekeeping and Stops

When the market got crushed last week, some our stocks were also thrown into the wood chipper. Many of them gapped down through the stops that we had. This happens on occasion and is always painful because you feel like you are in limbo. The stock is lower than the stop, so what do you do? By the way, I address this in the Joe’s Rules section of my blog)

As you know, one of my rules is to avoid early trading, usually the first hour. That’s when most of these stop violations occurred. Sometimes I bend that rule and I try to let you know when I do. Often stocks will gap down, then recover, sometimes they don’t. I wait, because sometimes it is just a powerful knee jerk over reaction and the price will improve. In the case of some of these stocks last week, they broke through the stops and went lower. The market didn’t give you chance to stop because they traded through the stop. I then have a decision to make. Do I take a bigger loss, do I buy more, or do I wait for price improvement? In this case I waited for price improvement. I am essentially bullish, so I waited.

The New Normal

Back in the day, when the market corrected, the correction could take months, now it seems the market sells off for three days and then the buyers show up. Asa result, the market always seems to “bail you out” if you are wrong for a few days on the long side. This trade has been working for about four years now, someday it won’t. This is another reason I held those longs and didn’t take stops at lower prices. The main reason though was because they got creamed through the stop and put us in a limbo situation.

The existing names on the list I am watching and will keep you posted.