Shares of companies in the coal industry have lagged in the market in 2012. Several miners are expected to reduce production further this year as demand falls in the U.S. and Europe. Many argue that Europe will need less U.S. coal as its economy struggles through a deep financial crisis. Meanwhile, with natural gas prices near ten year lows, North American Utilities companies are expected to rely more on abundant natural gas.

Natural gas prices could resume falling, spurring even more utilities to switch from coal to gas for power generation, and this winter was very mild.

All stocks have levels where you want to buy or short. Tom DeMark, who has been insanely accurate in calling short and intermediate tops and bottoms in the market stated recently that this market actually may not have a serious correction, but a series of mini sector rotations. From my perch, I think he’s right, as the same money just seems to keep churning from one sector to the next.

These names will find a level, but right now I’m not catching knives. Here is a look at some coal charts.

$KOL is the actual ETF for the sector. It has been breaking uptrend lines and the volume really picked up on Friday.

$WLT is my favorite name to trade, but it broke it’s 50 day moving average yesterday. I would be a buyer in the mid to high 50’s.

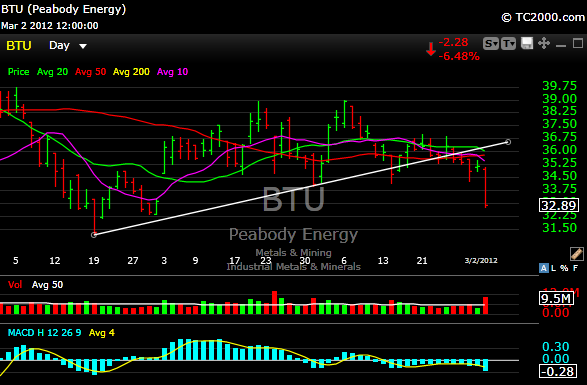

$BTU has clearly broken it’s uptrend line and dropped over 6% on Friday. Support is around the 30 level. That level is close, a break of that level takes it to the mid 20’s.

$ACI has been beaten like a baby seal. It’s on support, but a break takes it onto high single digits.

$ANR has some support around 15, so watch that level.

Take out the occasional take out rumor, $PCX is garbage.

Bottom line, when institutions rotate out of a sector it pays to get out of the way from the long side unless you are longer term the you can layer into longs. Riding their coattails from the short side is also the way to go, but I think “most” of the easy money may have already been made, although prices do look lower.

For more detailed set ups on a daily basis with specific entries and stops you can subscribe here. Good trading.