Last night Lazlo Birinyi said the S&P was going to 1300 by year end. Abbey Joseph Cohen who couldn’t make a forecast with next years Wall Street Journal is bullish as all get out. Roubini has eased on his incessant drone that the sky is falling. Ben Bernanke said the recession was over the other day. He also said we weren’t in a recession when we were neck deep in hell. He also said sub prime issues would have zero effect on the economy.Urban legend has it that investors buy the market six months before the recession ends, so Bernanke’s comments yesterday were perfectly timed considering it is now six months from the 666 low on the S&P.

Kudlow is wrong every time his lips move, but he has that damn Pollyanna clause in his contract. The global economy currently has five hundred empty shipping tankers,larger than the U.S. and British navy combined, floating baron just off the South China Sea. Normally at this time of year, these ships are brimming with product and commodities of all types, not this year, but the recession is over.

The White House said that the health care plan wouldn’t cost a dime, the Congressional Budget Office said no way Ray, it will cost so many billions. The White House said cap and trade would be a boon for the economy, the Congressional Budget Office just said take a chill pill, it will actually reduce our GDP by up to 0.75%.

The White House said that the health care plan wouldn’t cost a dime, the Congressional Budget Office said no way Ray, it will cost so many billions. The White House said cap and trade would be a boon for the economy, the Congressional Budget Office just said take a chill pill, it will actually reduce our GDP by up to 0.75%.

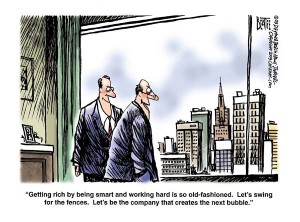

So where do you get your news? Who do you believe, who can you believe? The market right now is on fumes and I truly believe we are need of an overdue rest. Hedge funds are chasing performance, the sell side has new life and the research community can’t make upgrades and buy recommendations fast enough. When Potash was $250, they increased targets to $350, Rome was starting to burn at the time but they didn’t see it or didn’t care, everyone was doing it, it was all the rage. Potash went to $50, those analysts should be unemployed, many though were making upgrades on other stocks today.

My hedge fund is covered by some phenomenal sell side folks, their information is terrific. One of them works more with hedge funds, the other one covers the enormous mutual funds. We chatted at length today and I walked away feeling validated about my own thoughts about this market. The guy that covered the hedgies(fast money) was very busy, the guy that covers the mutual funds (sticky money) was beyond slow.

I’ve maintained for a while now, that the money in this market is not sticky money, it’s fast money, real fast. It remains to be seen if I will be right. I am longer than I’ve ever been the last few months and have scaling out of longs everyday. I do believe though, barring an unfortunate “event” that the market will probably buy the dip when we correct, if it doesn’t watch out below.

Developing……………….